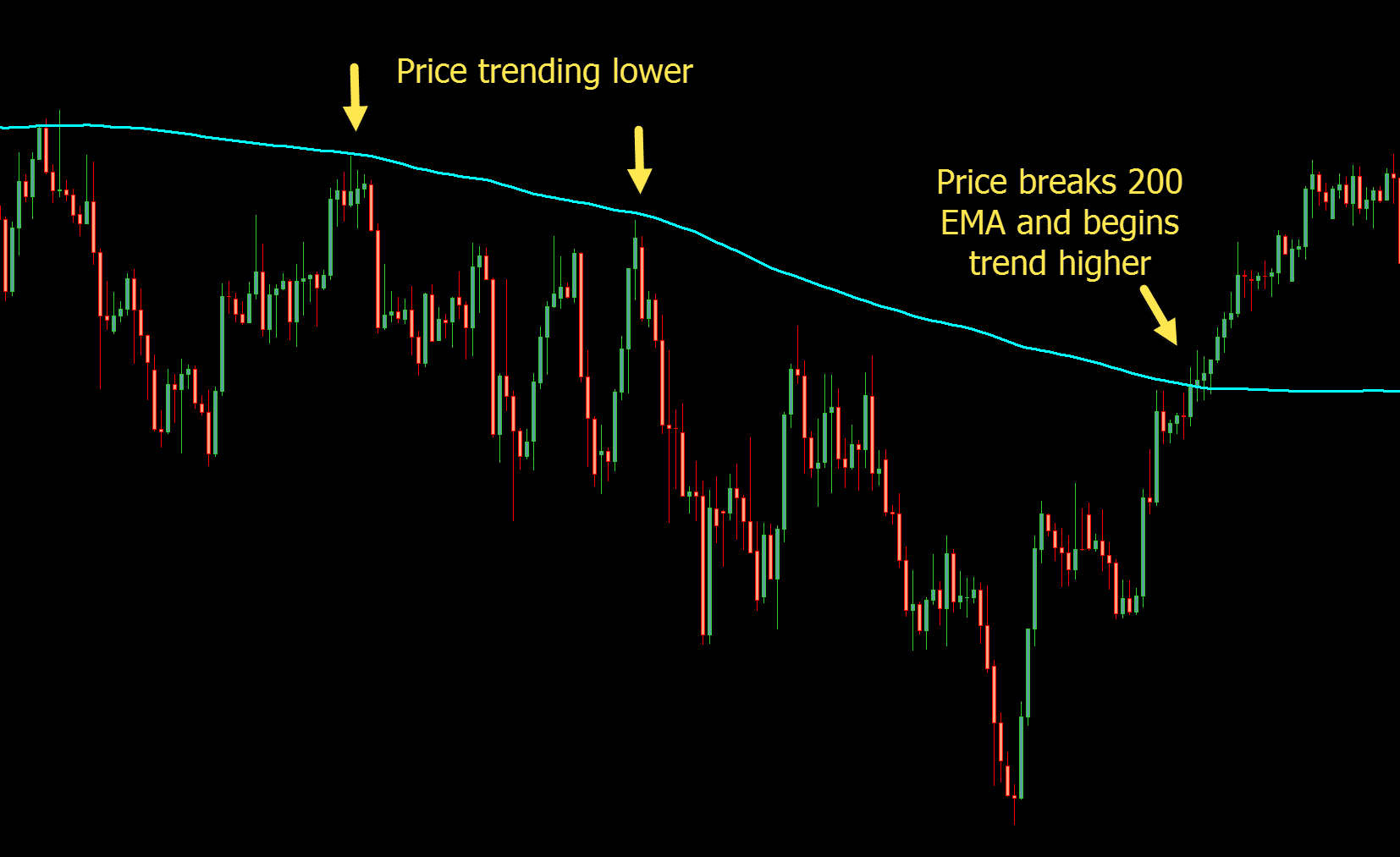

So there you have, the 200 EMA Trading Strategy…its a very simple and easy Forex swing trading system which you can start using.For other uses, see Moving-average model and Moving average (disambiguation). If one time frame is different, you wait until all are the same trend. What happens if the 4 hr and the 1 hr trend are the same and the daily is different?Įvery time frame has to match and have the same trend. Wait until 1 hr trend is the same as the 4hr and the daily chart which you can see when price trades above the average. What happens if the 1 hr trend is different from the 4 hr and the daily time frames? Dealing with them is quite simple though. With this trading strategy, there are 2 issues that are quite common. For managing your trade as it becomes profitable, use the trailing stop technique where you move your stop loss behind each subsequent swing lows or high as your trades moves in favor so that you continue to lock in your profit as price travels towards your take profit target level.Ĭommon Issues With The 200 EMA Trading SystemĮvery trading method will have times where not everything is running according to your plan.Use previous swing high or swing low on the 1 hr as your take profit target levels.Stop loss should be place at a minimum, 10-15 pips outside of the 200 ema line or below the levels indicated with the white arrows.Once you get confirmation with a candlestick pattern, place a sell stop order just 3-5 pips above the high of the reversal candlestick (if this is a downtrend and you are selling).Click this link on what reversal candlesticks to use. Use price action by the use of reversal candlesticks.We will use long trends for this example. Once price lines up on the right side of the EMA on all charts, we look to trade bounces from the 200 moving average. What we want to do here is to “buy the dips” and “sell the rallies” in the 1 hr time frame.It is in the 1 hr chart where your trade entries are executed when the trend in the 1 hr chart is the same as the 4 hr and the daily charts.

If yes, switch to the 1 hr chart and check if the 1 hr chart is in the same trend as the daily and the 4 hr charts.Switch to the 4 hr chart and see where the 200 ema is relative to the price, is it in the same trend as the daily chart.The daily chart determines the main trend. Place the 200 ema on the daily chart of your Forex pair.Here are the 5 steps to trading this Forex strategy The 200 ema strategy is a multi-timeframe forex strategy which means you need the daily chart, the 4 hr chart and the 1 hr chart.

THE 200 EMA TRADING STRATEGY AND HOW IT WORKS

0 kommentar(er)

0 kommentar(er)